Top AI Tools for Portfolio Management in 2025

December 9, 2024

Artificial Intelligence (AI) has revolutionized numerous industries, and the financial sector is no exception. Portfolio management, a cornerstone of financial services, has significantly benefited from integrating AI technologies. By leveraging advanced algorithms and machine learning techniques, AI empowers investors to make more informed decisions, optimize portfolios, and mitigate risks. This paper explores the diverse applications of AI in portfolio management, highlighting its potential to transform the investment landscape. Financial advisors can effectively utilize AI content writing tools to create compelling marketing materials, communicate complex investment strategies, and enhance client engagement.

Portfolio management is the art and science of selecting and overseeing investments that meet specific financial objectives. It involves making strategic decisions about asset allocation, diversification, and risk management to maximize returns while minimizing risk.

It determines a portfolio’sportfolio’sx of set classes (stocks, bonds, cash, real estate, etc.).

They are spreading investments across various asset classes to reduce risk.

They are assessing and managing the potential risks associated with investments.

Tracking the performance of the portfolio and making adjustments as needed.

AI has the potential to revolutionize portfolio management by offering several advantages:

AI can process vast amounts of data from various sources, including financial news, market trends, and economic indicators.

It can identify complex patterns and anomalies that may not be apparent to human analysts.

AI algorithms can forecast future market trends and potential risks.

AI-powered algorithms can execute trades automatically based on predefined rules and strategies.

AI can facilitate rapid trading decisions to capitalize on short-term market opportunities.

AI can analyze various risk factors, such as market volatility, credit risk, and operational risk.

It can help develop strategies to mitigate these risks and protect the portfolio.

AI can optimize portfolios to achieve the highest possible return for a given level of risk.

It can tailor portfolios to individual investor preferences and risk tolerance.

AI can analyze news articles and social media sentiment to gauge market sentiment and identify potential investment opportunities.

AI plays a crucial role in portfolio management by automating tasks, enhancing decision-making, and uncovering valuable insights. Some key areas where AI is making a substantial impact include:

AI algorithms can efficiently process vast amounts of data from diverse sources, including financial news, market trends, and economic indicators. This enables investors to identify patterns, anomalies, and opportunities that may not be apparent to human analysts.

AI models can predict future market trends and potential risks by analyzing historical data and current market conditions. This information helps investors make proactive decisions and adjust their portfolios accordingly.

AI-powered tools can assess and quantify various risks, such as market volatility, credit risk, and operational risk. This enables investors to build more resilient portfolios and minimize potential losses.

AI algorithms can optimize portfolios by considering risk tolerance, return objectives, and investment constraints. This leads to more efficient and diversified portfolios.

Empower is an AI-powered financial management platform combining advanced technology and human expertise. It offers real-time insights, optimized asset allocation, fee analysis, and personalized investment strategies to help you achieve your financial goals.

Sharesight is an AI-based tool for tracking investments across global markets. It supports multiple asset classes and provides insights into portfolio performance, dividend income, and tax reporting.

Wealthfront leverages AI to provide automated investment management. It offers tax-efficient investing, portfolio rebalancing, and financial planning tools for users at various investment levels.

Betterment is a robo-advisory platform offering automated portfolio management with AI-driven tools. It optimizes investments for retirement, wealth building, and general savings.

A research-focused tool for tracking mutual funds, ETFs, and stocks with in-depth analysis to guide serious investors.

Renowned for its research capabilities, it is excellent for evaluating funds and ETFs.

Paid premium features; interface may seem overwhelming to beginners.

Free basic tools; premium subscriptions start at $29.95/month.

Aimed at financial institutions and professional investors, this tool provides advanced AI for portfolio analysis, risk management, and compliance reporting.

Advanced analytics, risk assessment tools, and customizable solutions.

Primarily designed for professional investors; high learning curve.

Custom pricing based on solutions required.

A robo-advisor platform that automates portfolio management focusing on cost-efficiency and hands-off investing.

Low-cost advisory services, tax-efficient strategies, and a simple interface.

Limited customization could be better for active traders.

Free tracking; advisory services at 0.25% of assets managed annually.

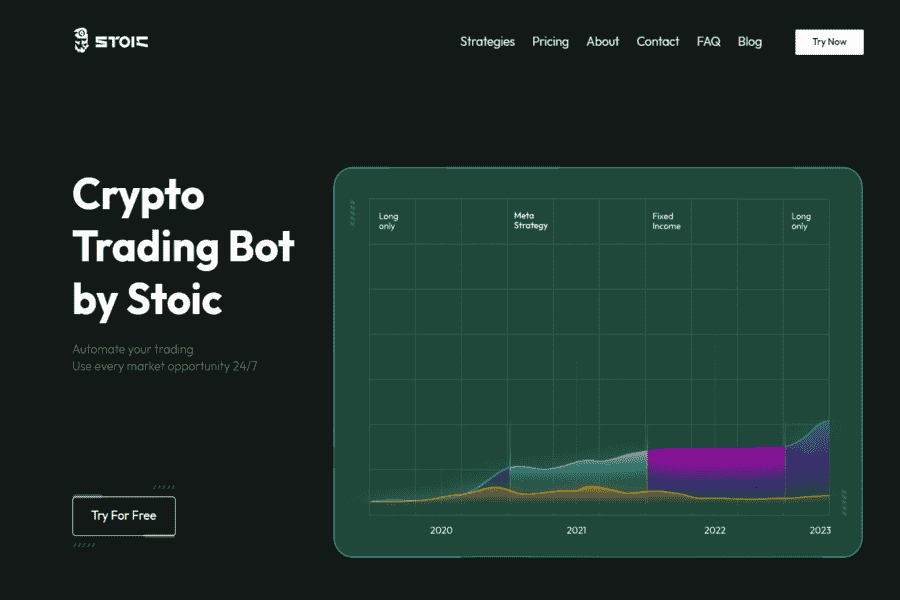

Stoic is a crypto-focused portfolio management tool that automates investment strategies using AI. It handles daily rebalancing and trend tracking, making it ideal for crypto traders.

Starts at $25/month for small portfolios and a 5% annual deposit fee for larger ones.

A user-friendly tool providing real-time trading alerts for stocks and options. Its algorithms identify opportunities and help traders execute strategies efficiently.

$99.97/month or $959/year. Free 7-day trial available.

A tool that provides 360° portfolio analysis with AI-driven recommendations. It consolidates investments across multiple asset classes for comprehensive insights.

Free for basic; premium options vary.

Designed by Fidelity, this tool provides a consolidated view of linked financial accounts, covering investments, loans, and insurance. It includes net worth tracking and retirement analysis.

Free for Fidelity account holders.

Kubera is a comprehensive portfolio tracker integrating stocks, crypto, NFTs, and physical assets like real estate and cars. It provides a centralized dashboard for all assets.

$150/year with a 14-day free trial.

A platform providing algorithmic trading and AI-powered backtesting tools for developing and deploying investment strategies.

Comprehensive data access, multi-asset backtesting, and integration with brokers.

The steep learning curve for non-technical users.

Free for community use; subscription-based pricing for advanced features.

AI-enhanced research platform for financial professionals, helping analyze data, track companies, and identify trends efficiently.

Improves research speed, customizable dashboards, and broad data integration.

Expensive and focuses more on research than direct portfolio management.

Subscription-based; pricing details available on request.

AI-powered platform for data aggregation and financial insights, offering comprehensive client portfolio overviews.

Simplifies financial data organization is widely trusted and enhances fintech applications.

Requires integration with other platforms for full functionality.

Pricing on request.

Automated investment management tool offering personalized financial plans, diversified asset allocation, and 24/7 AI support.

Community fund support, real-time assistance, and asset diversification.

Limited advanced analytics.

A freemium model with additional paid features.

AI-driven analytics for financial markets, including event recognition and forecasting tools for investment planning.

Advanced forecasting, event-driven analytics, and user-friendly design.

High cost and specialized features may only suit some users.

Pricing is available on request.

AI algorithms can process vast amounts of data from various sources, including market trends, economic indicators, and company financials. This enables portfolio managers to identify patterns and correlations that human analysts might miss. By leveraging machine learning, AI can make more informed decisions, such as:

AI can forecast future market movements and identify potential investment opportunities.

AI can gauge market sentiment and adjust investment strategies by analyzing news articles, social media posts, and other textual data.

AI can tailor investment recommendations to individual investor risk profiles and financial goals.

AI automation can streamline many time-consuming tasks, freeing up portfolio managers to focus on strategic decision-making. Some examples include:

AI can automatically gather data from various sources and clean it for analysis, reducing manual effort and potential errors.

AI can monitor and automatically rebalance portfolios to maintain optimal asset allocation, saving time and reducing transaction costs.

AI can generate detailed reports on portfolio performance, risk exposure, and other relevant metrics, providing valuable insights to investors.

AI can help identify and mitigate potential risks in investment portfolios. By analyzing historical data and real-time market information, AI can:

AI can assess the risk associated with different investments and identify potential vulnerabilities.

AI can simulate various market scenarios to evaluate a portfolio under adverse conditions.

AI can detect anomalies and suspicious activities that may indicate fraudulent behavior.

By leveraging AI-powered insights and automation, portfolio managers can achieve better investment performance:

AI-driven algorithms can execute trades optimally, taking advantage of market opportunities.

AI can identify and exploit factors that drive stock returns, such as value, momentum, and quality.

AI can dynamically adjust asset allocations based on changing market conditions.

While AI offers significant advantages,it’sscruciait’ss acknowledge and address potential challenges:

AI models rely on high-quality and sufficient data to learn and make accurate predictions. Insufficient or low-quality data can lead to biased or inaccurate results.

Implement rigorous data cleaning techniques to remove noise and inconsistencies.

Generate additional synthetic data to increase the size and diversity of the dataset.

Continuously monitor data quality and identify potential issues.

Complex AI models, especially deep neural networks, can be difficult to interpret and understand. This lack of transparency can hinder trust and decision-making.

Utilize techniques like feature importance analysis, attention mechanisms, and LIME to explain model decisions.

Consider simpler models that are easier to interpret, such as linear regression or decision trees.

Incorporate human expertise to validate and refine AI-generated insights.

AI algorithms can perpetuate biases in the training data, leading to unfair and discriminatory outcomes.

Develop fair and unbiased algorithms by addressing biases in data and model design.

Adhere to ethical guidelines and regulations to ensure responsible AI development and deployment.

Be transparent about AI systems and their limitations, and hold developers accountable for their actions.

The future of AI in portfolio management is indeed promising. As AI evolves, we can anticipate even more sophisticated and impactful applications. Here are some key trends to watch:

These digital advisors will become increasingly sophisticated, utilizing advanced machine learning algorithms to tailor investment strategies to individual investor needs, risk tolerances, and financial goals.

AI can continuously monitor market conditions and adjust portfolios in real-time to maximize returns and minimize risk.

AI can automate much of the due diligence process, analyzing vast amounts of data to identify potential investment opportunities and risks.

AI can develop more accurate and complex risk models, enabling better risk assessment and mitigation.

AI-powered HFT algorithms will execute trades at incredibly high speeds, capitalizing on microsecond-level market inefficiencies.

AI can identify complex patterns and relationships in market data, enabling quantitative strategies to outperform traditional approaches.

As AI becomes more pervasive,it’sscruciait’ss develop ethical frameworks to ensure fair and unbiased decision-making.

AI can help identify sustainable investment opportunities and assess the impact of investments on the environment, society, and governance (ESG).

In conclusion, AI has emerged as a powerful tool for portfolio managers, offering many benefits. AI can significantly improve investment outcomes by automating tasks, enhancing decision-making, and improving risk management. As AI technology evolves, we can anticipate more innovative applications, such as personalized investment advice, advanced predictive analytics, and autonomous trading. However, it is crucial to address the challenges associated with AI, including data quality, model interpretability, and ethical considerations. By striking the right balance between human expertise and AI capabilities, investors can harness the full potential of AI to achieve long-term financial success.